Are investors crowding millennials and first-time home buyers out of the market?

Any economist will argue that investors impact housing markets – particularly in Canada, where investors make up over 20% of new housing mortgages.

Consequently, with rapidly rising housing prices (despite the pandemic, Canadian housing prices have gone up 40% due to low interest financing options and increased demand for detached housing), we have a problem. 2021 was a record breaking-year: the market saw 667,000 transactions, a 21% increase since the previous year. As we enter 2022, the Canadian housing market upholds a tight demand-supply condition.

Making Room for Millennials

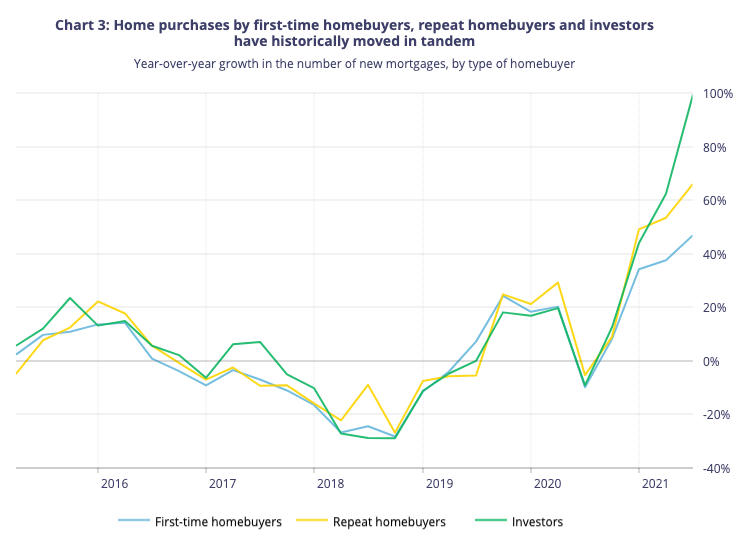

Inventories of homes have reported historical lows resulting in fierce competition between buyers, driving up prices, but it is essential to recognize the types of buyers at play. For example, the Bank of Canada recently released a study classifying the types of homebuyers across Canada, unsurprisingly reporting an increase in residential investors, and as of 2021, they accounted for slightly more than one-in-five purchasers. This increased activity is raising affordability concerns as the share of purchases from first-time buyers reached new lows in 2021. With housing inventory scarce across the country, Canada must prioritize properties as homes rather than a positive return on investment. In fact, according to the National Bank of Canada’s Housing affordability monitor, the time required for a representative household to save for the down payment on a home at a savings rate of 10% is close to 347 months in Vancouver and 307 months in Toronto.

In Canadian housing markets, the dream of home ownership may never become a reality for some millennials or first-time home buyers without creative financial solutions or support. A recent survey conducted by TD Bank suggests that close to half (49%) of millennial buyers rely on their parents for financial support to make a 20% down payment. To put this in perspective, only two decades ago, just 14% of first-time home buyers relied on financial support from family for a down payment.

Policy reform on investors

Homeownership into an investment strategy is impacting affordability across the country. In 2022, governments at every level pledged to impose stricter regulations on investment property owners with increased down payment requirements, higher taxes, and banning foreign buyers. In addition to policy reform, the Bank of Canada plans to increase interest rates by mid-year, further disincentivizing property purchase investment and attempting to curb the housing affordability issue.

However, the impact on the rental market supply is an important consideration. As the Globe and Mail recently reported, many of these “Mom and Pop” real estate investors provide much-need rental and affordable housing supply. The policies being put into place are not meant to punish these investors but certainly the larger down payment and higher interest rates may discourage them.

Looking ahead

Government policy is an important part in regulating investors, protecting homeowners and creating affordable housing but governments can’t do it alone. As we covered in our insights post “Expanding Industry Innovation into the Housing Market Flow”, housing supply is consistently falling short and without innovative solutions to bridge the gap, we’ll fall short relying on policy alone. In this case, those “Mom and Pop” real estate investors could exit the market and our rental market supply diminishes.

What’s your take on solving housing supply? How can we make housing more affordable? Reach out to us to continue the conversation.