After seeing exponential growth since the last recession, real estate companies are more willing than ever to embrace new technologies and innovative solutions that will help grow their businesses. In the article below, R-LABS’ Research Manager, Lovish Gupta, discusses the advantages of blockchain in real estate and shares tangible examples of this technology at work.

How Does Blockchain Work?

A blockchain is a tamper-evident, shared digital ledger that records transactions in a public or private peer-to-peer network. Distributed to all member nodes in the network, the ledger permanently records the history of asset exchanges that take place between the peers in the network in a sequential chain of cryptographic hash-linked blocks. Its benefits include greater transparency and trust, enhanced security, improved traceability, increased efficiency, lower error, and reduced cost.

The decentralized-record-keeping technology enables companies to realize several business benefits including:

Greater transparency and trust

Enhanced security

Improved traceability

Increased efficiency and lower error

Reduced costs

Every day, companies throughout the real estate industry are finding use-case scenarios to apply blockchain and improve existing processes. Whether you’re a developer, mortgage broker, bank, or real estate agent, there is a steady stream of new blockchain applications that will impact the way you do business. At R-LABS, we’re exploring how this revolutionary technology will impact and disrupt traditional real estate practices. Here are just a few of the areas benefiting from blockchain technology in today’s market.

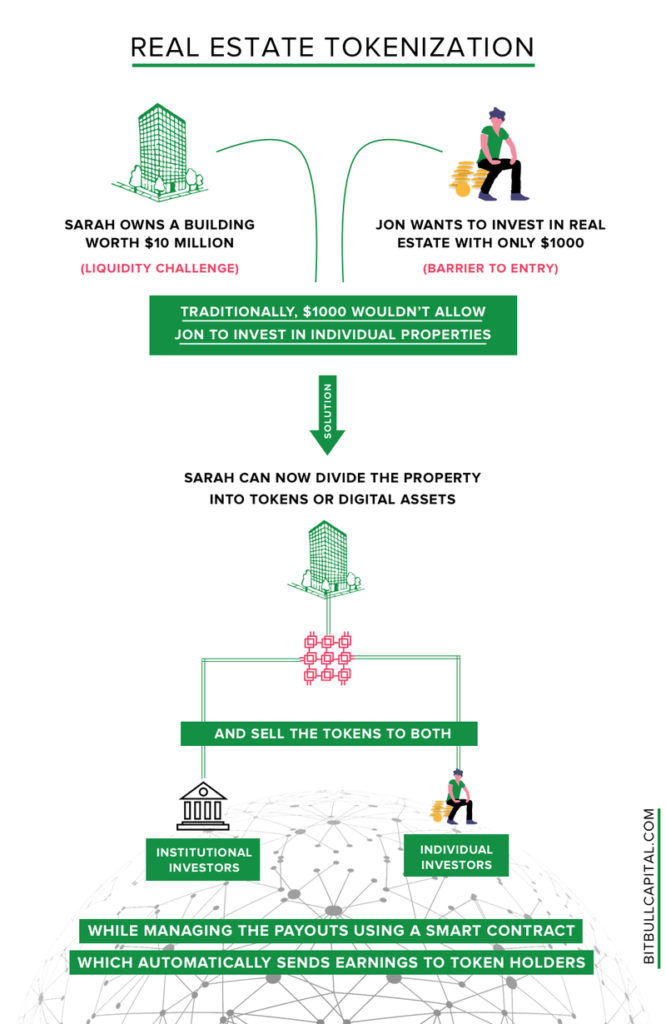

Fractional Ownership & Tokenization

Real estate tokenization allows property owners to issue tokens, representing a certain number of shares for some real estate asset, through blockchain platforms. This approach makes it easier to create a market for property “micro-shares” – generating the potential for a property to effectively have numerous co-owners. Investors can purchase these tokens and become partial owners of that asset with greater involvement in cash flows and asset appreciation. This not only resolves the buyer affordability problem with real estate but also allows investors to have a more diversified portfolio. At the same time, they have the freedom to sell any amount of their shares whenever they want and probably through some other online markets as well.

In March 2019, Inveniam Capital Partners (ICP) announced plans to tokenize some $260 million in four private real estate and debt transactions, starting with a WeWork-occupied building in downtown Miami, Florida. There are many blockchain-based real estate tokenization platforms that currently exist, though most are still in the development phase. We have highlighted our pick on the company landscape chart at the end of this report.

Title Management

According to the American Land Title Association, more than 25% of title reports detail some type of defect to the title, primarily due to the centralization and paper-based manual recording system. This introduces high title insurance and related costs due to the chain of title and lien recording issues, fraud risk, required diligence, and cumbersome clearance process. If all property title was decentralized on the blockchain, an immense amount of time and money would be saved, and it could potentially eliminate the need for title insurance altogether. A transparent and decentralized public ledger for land information management could even become as a permanent database or registry of all property rights and historic transactions.

Some companies and governments around the globe have already implemented blockchain technology for the title management process. Recently, Blockchain-based real estate platform Propy announced that it has completed the sale of a $1.6 million San Francisco property owned by TechCrunch co-founder, Michael Arrington. Blockchain land registry startup Ubitquity announced a pioneering partnership with the Brazilian Real Estate Registry Office. Brazil faces a high rate of corruption and fraud especially when it comes to land titling system. Ubitquity’s pilot in Brazil showed that real estate records could be compared to their counterparts on the blockchain – proving the legitimacy of records to all parties involved.

Buying and Renting Property

MLS is an information-sharing platform where agents mutually help one another to sell their inventory. While commission distribution between the broker parties incentivizes this arrangement, accessing this centralized information requires a high sign-up fee from the subscribers. Furthermore, the data can be incomplete, fragmented and outdated.

A blockchain-based MLS would enable data to be distributed across a peer-to-peer network in a manner that allows brokers to have more control over their data, along with increased trust, as listings would be more freely accessible. This enhanced, blockchain-enabled MLS would also provide clear details on property location and address, comparable rental rates, capital values, ownership history, tenant details, age of the property, and title clarity. Overall, subscribers will not need to pay high fees and can have access to more reliable data.

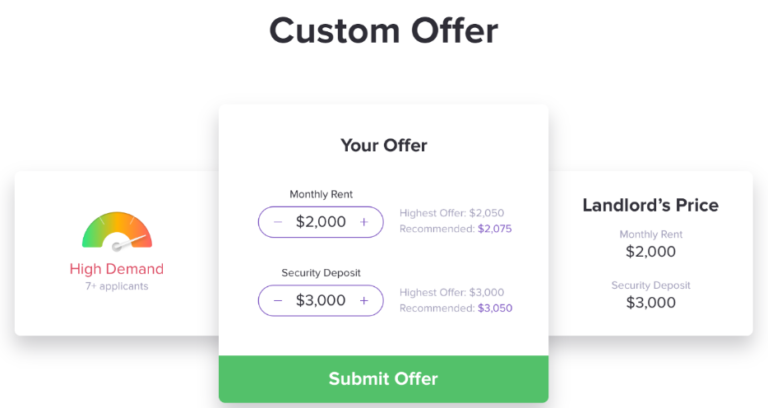

Companies such as Rentberry, have launched innovative solutions to eliminate the middlemen and all the third parties in between. The company allows tenants to submit custom offers and compete in the bidding process while creating more transparency between landlord and competing bids. After the bidders have climbed over each other to get to the top, the landlord can then choose the highest-paying tenant, although, with Rentberry’s built-in credit check and referencing system, they may choose another, even if they’re not offering the most money. Rentberry users can put in higher bids, and everyone will be able to see the current highest bid.

Smart Contracts and Due-Diligence

The act of buying and transferring ownership of the property remains a tedious and lengthy process. These transfers typically need to be reviewed and confirmed by an array of intermediaries, including agents, lawyers, and governmental bodies.

Smart Contracts check the possibility and legitimacy of the transaction. No agreement can be concluded if its terms do not meet the established standards. Transactions can be done in far less time with lower probability of fraud. The seller/landlord includes all details of the property and the buyer/tenant puts all of their necessary information on a 100% encrypted and secure block. Computer protocols check the legitimacy of the transaction and no agreement can be completed until all of the terms are met. Smart contracts execute themselves automatically once the requirements are met.

“The practical consequence […is…] for the first time, a way for one Internet user to transfer a unique piece of digital property to another Internet user, such that the transfer is guaranteed to be safe and secure, everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer. The consequences of this breakthrough are hard to overstate.”

– Marc Andreessen

Implementing Blockchain Solutions in Real Estate

The impact of distributed ledger technology may be greater than any of us realize — it has the potential to change economics, business, and society. It just takes time, as all the good things in life do. However, in order to scale the adoption of technology, we’ll have to overcome some hurdles.

From consortia and governance to speed and user experience, blockchain and its applications have a lot of growing to do before they can be widely adopted within the industry. According to the Altus CRE Innovation Survey, only 37% of respondents expect blockchain to start having an impact on the CRE industry within the next two years, however, 10% of CRE executives “don’t really understand blockchain and what it does”. If these issues can be solved successfully, blockchain-based property ownership will have a promising future, and they will be backed by the trend towards asset-backed tokens that is present in the overall blockchain scene.

Overall, real estate is witnessing disruption with the advent of new technologies – including AR/VR, IoT, artificial intelligence and modular construction. The sector has been a laggard when compared to other industries and given the complexity and current nascent stage of blockchain, we expect this space to grow at a slower pace as compared to other technologies. However, if blockchain applications can generate government support, the growth can be accelerated. It’s evident that the concept of blockchain is certainly disruptive, but we’ll likely need more examples of these solutions in action before we see significant adoption in the real estate industry.