In order to meet demand in major cities while providing affordable options, the supply of new housing requires significant change to the development process from the government. With this in mind, R-LABS Research Manager, Lovish Gupta, set out to uncover alternative options or people who have difficulty renting or buying a home. Our research below discusses the potential of co-living and fractional ownership in solving the housing affordability crisis.

Evidence continues to pile up revealing that housing affordability is getting worse in Canada – particularly in major cities like Toronto and Vancouver. According to the National Bank of Canada’s Housing affordability monitor, the time required to save for the down payment on a representative home at a savings rate of 10% is close to 342 months in Vancouver and 92 months in Toronto. An RBC Research report states that Canadian households now need higher incomes to qualify to buy a home which leaves many Canadians frustrated. And while experts say we shouldn’t spend more than 30% of our income on housing, there are thousands of struggling Canadians who spend more than half their income on rent. With the financial stresses of homeownership at an all-time high, it’s time for us to rethink the affordability puzzle.

Many companies are trying to tap into this opportunity, but the potential seems to be massive. For context, ~790,000 beds have been built in the US alone since 1995, which only tap the student housing market. Compare this to an inventory of only ~3,200 co-living beds built by the major seven players highlighted below. The high demand for these places shows just how many people are looking for roommates as a way to save money on housing costs. The co-living leader, Common, has received almost 10,000 applications to fill its nine residences across three major US cities in 2016, and Scarcity had a waitlist of more than 8,000 people in early 2018.

Fractional Ownership: Sharing Home Equity

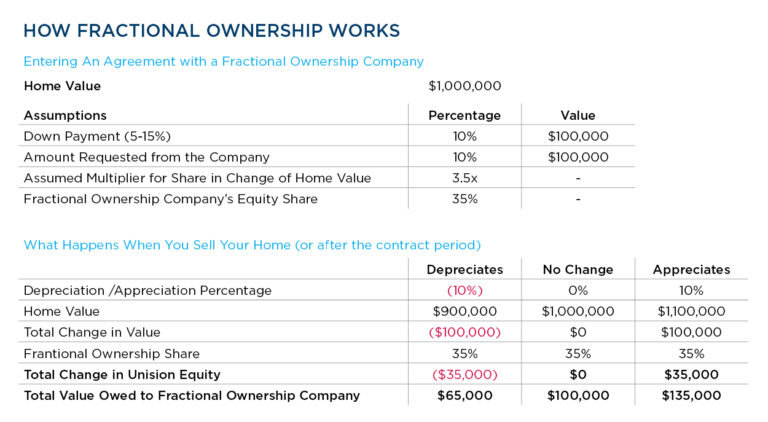

Fractional ownership, or “shared equity”, is a novel concept that allows home buyers and homeowners to tap into the future value of their homes in exchange for cash. An investment company offers funds in exchanges for a share of home’s growth – providing homeowners with an alternative option to a home equity line of credit (HELCO) and allowing home buyers to substantially increase their down payment at the time of purchase. Rather than charging a fee at the time of the agreement, the amount the home buyer needs to pay is calculated and repaid based on the home’s equity at the time of sale. Since there is no interest cost or mortgage involved for the upfront cash, fractional ownership can significantly reduce the financial burden and monthly commitments of the recipient.

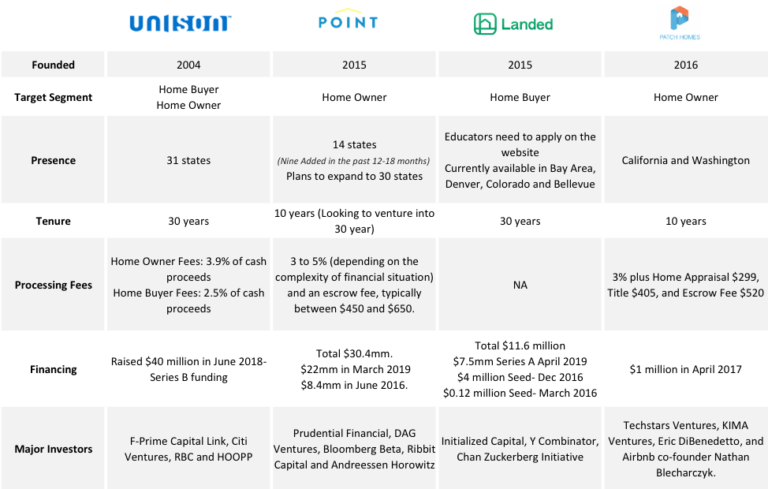

The concept of fractional ownership is gaining ground in the US, but Canada is yet to see a major venture driving the shared equity business. Looking at the US market, four companies, Unison, Point, Landed and Patch Homes have been trying to reinvent the wheel, by offering people cash in exchange for a share in their new or existing homes. Going through the fine prints, the business model for each venture varies, but this has not stopped investors from putting in money in these companies.

Solving Housing Affordability

At R-LABS, we’re drawn to the resourcefulness of co-living and fractional ownership. These creative business models empower people to navigate obstacles in our system and get into the home that is right for them. While we believe there is tremendous potential in these two sectors, the reality is housing affordability crisis is a multi-faceted issue that can’t be solved with a single idea. Governments, private companies and the general public alike will need to work together and create new models that make housing more accessible for the long-term.