But the concept of company building is gaining popularity. And the idea that two thirds of ventures fail is slowly changing. After the inception of Idealabs in 1996 – the longest running technology incubator, company builders have since seen explosive growth, increasing 625% in less than a decade. Why? Because people are recognizing the value that company builders bring to the start-ups that they nurture. A staggering 84% of studios coming out of start-up studios go on to raise a seed round. Out of these 84%, approximately 72% make it to the Series A round. In comparison, traditional start-ups have a much lower rate of making it to the Series A round, with approximately 42% of companies graduating from the seed round to a Series A stage. These questions are heavily researched and debated prior to making any infrastructure decisions. With real estate and infrastructure sectors overlapping, we’re seeing traditional real estate private equity firms developing significant infrastructure funds and capabilities.

How Company Builders Achieve Success with Blueprints and Resources

The big question that remains is what contributes to a start-up’s success? The company builder approach is achieving 30% better results due to its innovative approach to creating ventures. These results stem from the repeatable processes, leveraging sector specific expertise, and working with amazing co-founders and partners. The venture building process facilitated by company builders is not just successful, it is also swift and cost effective.

Risk? What risk? With company building, its blueprints and resources position start-ups for success, outweighing the risks involved in traditional start-up processes. The company building approach is not a random process. Rather, it is an iterated, repeatable journey supported by pooled resources, industry experts, and financing.

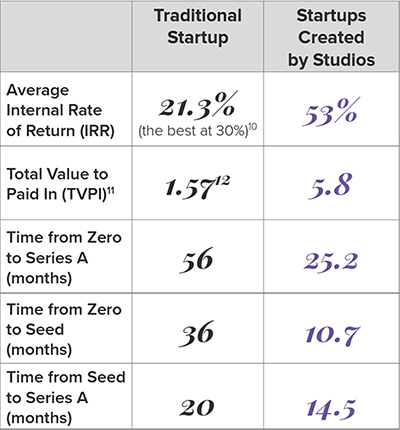

Global Startup Studio Network (GSSN) surveyed 258 start-ups created by company builders, and the results are highlighted below. It is obvious that from the start-ups surveyed that those built by start-up studios not only delivered a higher return, but also reached the Series A round in almost half the time compared to traditional start-ups. Company building presents a unique opportunity to maximize returns in a lower risk manner, while also solving the biggest sector challenges.

This capital efficient model tests start-ups and guides, enabling them with the ability to scale, while providing all the needed resources so that the co-founders can focus on the customer and delivering the best product. As more data is gathered regarding company builder ventures, this value creation is what will drive investors and entrepreneurs into the start-up studio, innovating the way we see traditional capital structuring, and innovating the world of investment.