To the average Canadian homebuyer, soaring national real estate prices has made the concept of home ownership a challenge. In major cities like Toronto, the average property price has increased by a staggering 125% over the last decade, and steadily increased by 22% on a year-over-year basis from March 2020 to March 2021.

Coming as a surprise to many, the pandemic has accelerated pre-COVID housing trends with home sales reaching record highs. However, incomes are not rising at the same rate as home prices. The median Canadian income only grew 32.13% from 2010 – 2020, representing an annualized wage growth of 2.8% a year. The disparity between incomes and housing prices has created an affordability problem for Canadians looking to buy homes, particularly first-time homebuyers.

We Need Affordable Housing Solutions

As one might imagine, this scenario has made it increasingly difficult for the average household to purchase a home. Although individuals have the household incomes to support mortgage payments, they lack the savings required for down payment, which could significantly delay or even disqualify them from the home purchase process.

A 2019 RBC study shows that only 20% and 12% of families in Toronto and Vancouver respectively are able afford an average home. A household would need to spend some 66% and 82% of what it pulls in Toronto and Vancouver respectively to cover ownership costs, which is more double than the CMHC’s 30% benchmark for affordability.

Even with stringent savings plans, it will take the average home buyer 92 months to save a 10% down payment in Toronto. In Vancouver, it will take 342 months. Currently, there are 1.5 million and 591,000 renter households in Ontario and British Columbia respectively, representing a large group of potential homebuyers.

What more is that prices are expected to rise even higher as Canada plans to welcome 1.2 million immigrants over the next 3 years, to compensate for low immigration between 2019 and 2020. By design, this will result in increased home buying activity in major cities. This poses the question: How can we create solutions to this affordability problem so that larger populations can regain access to Canadian cities?

Housing Affordability & Fractional Ownership

One way to make home ownership more accessible is through fractional ownership.

Fractional ownership is the concept of purchasing and owning “fractions” or “shares” of a particular asset, such as a home. The asset is split between different investors with varying stakes. In many cases, factional ownership reduces the cost of real estate investment, while enabling a greater pool of potential investors who would have otherwise not been able to invest in the market.

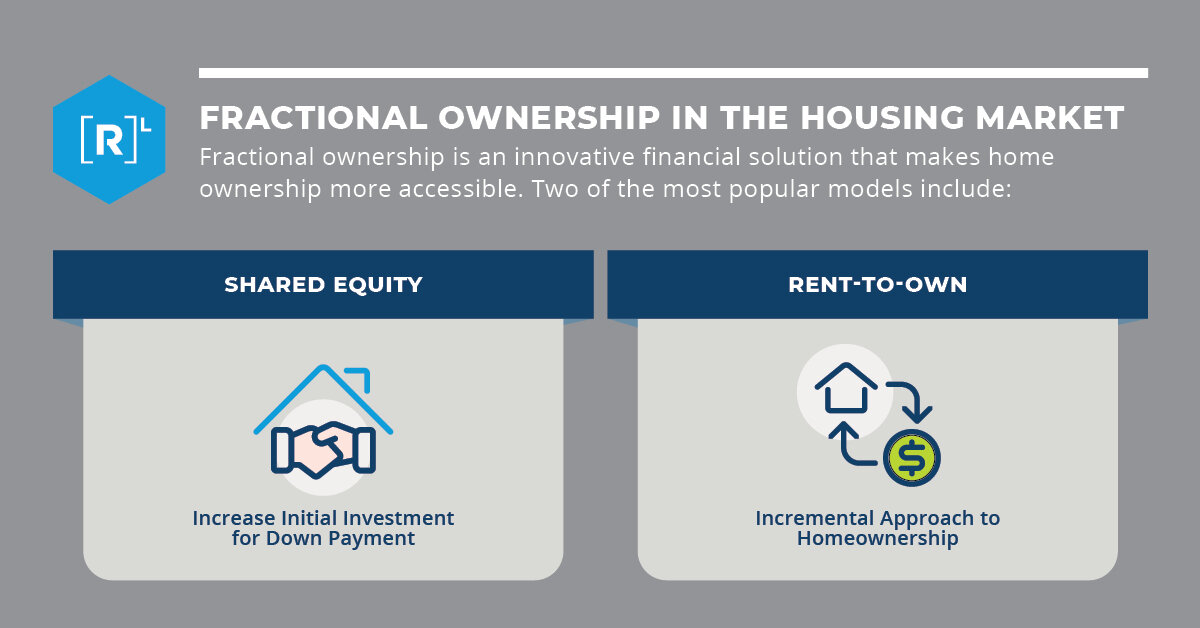

There are multiple approaches to fractional ownership, but two of the most popular options are shared-equity and rent-to-own.

Shared Equity

Shared equity is when a company acts as an investor and joins the homeowner as an equity partner in the home by purchasing a stake in the house using investor equity. At the time of sale, the shared equity investor would provide the homebuyer with a one-time contribution towards the down payment that would be paid back when the home is sold.

For example, if a person buying a $600,000 house in Toronto would need a down payment of $30,000 (5%) to qualify for a mortgage. But because they would be putting down less than 20%, they would also be required to take mortgage loan insurance which could add tens of thousands to their total mortgage. Avoiding these added costs would require the homebuyer to save a total of $120,000 (20%) for their down payment. In a shared equity arrangement, the homebuyer could put $30,000 towards the home while the company puts down the remaining $90,000. The homebuyer would then move into their new home and after time passes, could either pay back the initial investment and any applicable interest through the sale of the home or buy out the investor through their savings.

This model enables homebuyers to purchase right-sized housing in high-demand neighbourhoods without the added cost of mortgage loan insurance. For the company, it’s an opportunity to invest in the housing market and profit from the appreciation of the home while supporting individuals on their homebuying journey. Today, there are several private and public organizations offering shared equity programs including the Canada Housing and Mortgage Corporation’s (CMHC) First-Time Home Buyers Incentive.

Rent-to-Own

In the rent-to-own model, an investor or company would purchase the home and enter a rental agreement with a prospective homebuyer. The arrangement allows the renter to transition to home ownership by contributing a small portion to the initial down payment (typically 2-5%) and then growing their share of the home equity through a percentage of their monthly rent payments.

Rent-to-own is more flexible than other arrangements because it provides prospective homebuyers with a valuable commodity: time. It enables renters to pursue homeownership at the pace that’s right for them by removing the need to save a down payments and allowing them to determine the length of the agreement. For example, a renter could opt for a short-term living arrangement that allows them cash out on their investment and move on to another home at any time. Alternatively, they could choose to stay in the home long-term and become the sole owner of the home over time.

The Future of Fractional Ownership

The cost of housing is rising at a rate that many prospective homebuyers cannot keep up with. Average home prices continue to soar, which is particularly problematic to first-time buyers and people living in under-housed conditions. We need to reconsider what home ownership looks like so we can make it more obtainable to the thousands of people who have been priced out of the market.

There may not be a one-size-fits-all answer, but fractional ownership is a solution for people with limited savings. At the Lab, we’re exploring opportunities to turn fractional ownership and other alternative financing solutions into purpose-driven companies that support hard-working Canadians. We believe that if we can remove financial barriers in the home buying journey, then we can help people get into the right home sooner while creating innovative investment opportunities for our industry.

As a first-time homebuyer would you use fractional ownership for your home purchase?