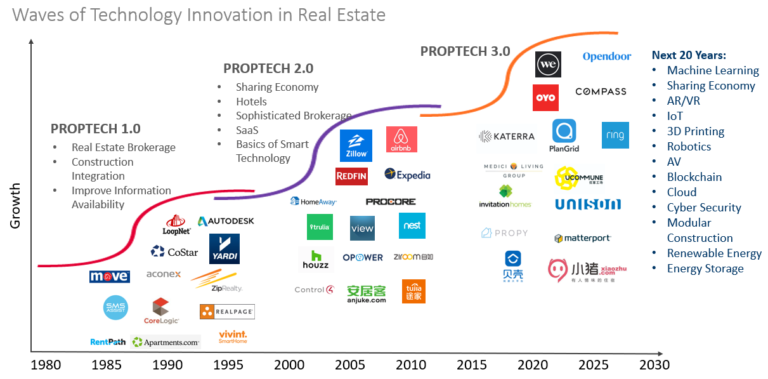

Considering the substantial growth in technology innovation, many real estate companies are looking to make investments in PropTech but are often unsure of the course ahead. R-LABS’ Research Manager, Lovish Gupta, is dissecting patterns from PropTech 1.0 and PropTech 2.0 to help our industry make more informed decisions and better investments in this space.

PropTech 1.0: Resisting Change

During PropTech 1.0, companies were trying to solve traditional problems related to construction, brokerage, and property management. Unfortunately, the overall infrastructure and support from the industry were not conducive to growth. The industry thrived on intricate personal relationships and insider knowledge, which were difficult to automate. Despite heated efforts from start-ups, commercial real estate largely resisted new technology. Collaboration was another issue. Many brokers and managers were not comfortable using the new technology which impaired growth in the sector.

With the spectacular rise and subsequent crash of the dot-com era, few companies were left standing after the dust had settled. Companies like Yardi, CoStar and Argus established themselves by providing apparently comprehensive closed-form enterprise services but often required substantial customization by the client. The companies who were able to adapt provided significant returns to investors.

PropTech 2.0: Digitalization in Real Estate

In the 2000s, the internet and mobile devices saw an unprecedented upswing. This created a robust infrastructure for innovation to flourish and the number of internet users increased from ~360mm in 2000 to ~4,383mm in 2019. The bridge between PropTech 1.0 and PropTech 2.0 appears to be residential real estate. As more public information (prices and rents) became available, this sector embraced new solutions and presented entrepreneurs with opportunities to cater to the masses.

Concepts like sharing economy, hotel bookings, brokerage, and data gathering started gaining ground. Expedia and Airbnb led growth in the hospitality industry, while players like Zillow and Trulia improved the methodology of finding a “dream home”. The growing availability of tech talent enabled start-ups to employ more advanced technology such as Data and Analytics while using a pay-to-use or Software as a Service (SaaS) business model.

PropTech 3.0: Problem-Focussed Verticals

More recently, PropTech 3.0 commentators have pointed out a revolution in technology adoption. KPMG’s 2018 PropTech survey reported that 97% of respondents believed that digital and technology innovation will impact their business. PropTech 2.0 improved digitalization of the real estate industry, but smart technologies like artificial intelligence, IoT, mixed reality, and blockchain allowed the real estate industry to enter a stage of shakeout and disruption.

Real Estate is often termed as a laggard in innovation, but that doesn’t mean that real estate managers are “technophobes”. In fact, during our interaction with various industry personnel, most of them are curious and willing to adopt technology, if there is a proven use-case that fits their requirements. The primary hindrance to be an innovator is the uncertainty in results. The fixed costs associated with traditional real estate are much higher than in other asset classes, often resulting in a smaller window to spend on innovation. The key would be incorporating a bottom-up approach to address complex enterprise needs instead of being adapted from products of other sectors.

The days of handshake deals, gut decisions and paper trails are fading. Learning from PropTech 1.0, our focus would be on filtering out the noise and concentrating on ideas that solve the core real estate problems. Investment opportunities are strong in this sector but before we jump in, it’s vital that we assess patterns from the previous waves of innovation and take calculated risks in this space.