Real estate and infrastructure: the blurring divide between the two sectors is a trend growing more apparent, especially in terms of capital investment. As the lines between asset classes converge, it is becoming increasingly important to understand why.

Real estate is a key component of any infrastructure project. Extending a transit line? One of the most vital considerations is the housing which will be created around the extension. Will the city ask for more density, and will people be attracted and willing to move to the area surrounding the extension? Another example of the blurring divide could be development of a hospital. While this is considered social infrastructure, the surrounding real estate must also be taken into consideration. How should the surrounding housing divisions be structured? Will being near a hospital boost or negatively impact the residents’ standard of living and how will that impact prices in the vicinity?

These questions are heavily researched and debated prior to making any infrastructure decisions. With real estate and infrastructure sectors overlapping, we’re seeing traditional real estate private equity firms developing significant infrastructure funds and capabilities.

Surprisingly, these sectors used to be closer. A few decades ago, most of the private investors who partook in infrastructure investment did so to capture underlying value from real estate investments. However, as the industry progressed, firms began to specialize, drawing them away from infrastructure and hyper-focusing them on the real estate sector. Today, with explosive growth across both sectors, investors are once again looking at diversification, drawing them back towards infrastructure investments.

Shift in investment strategy is driven by long-term opportunities and the Greater Toronto Area (GTA) could be a great example. The GTA is projected to be the fastest growing region in Ontario with its population increasing by 2.9 million, or 41% to approximately 10 million people by 2046. In order to house this influx of people, the GTA will need better infrastructure. This means not just better housing, but also more connectivity with the transit system, and additional commercial spaces to work and indulge in leisure activities. Investing in infrastructure presents the opportunity to earn a stable return while creating value.

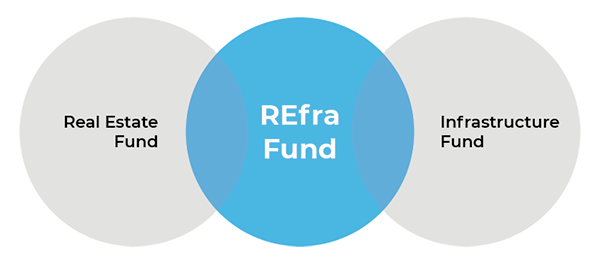

Capital previously solely invested in real estate is now also being invested into infrastructure by institutional investors. With capital pools blending, investors are beginning to realize that real estate is, in fact, infrastructure. As this new mode of investment gains popularity, a new term is being coined: “REfra.” If this new method of investment gains traction the same way its new name has, we may soon see a new normal for investment.