The Power of Venture Building in Solving Major Problems in Real Estate and Housing Through Active Partnership Between Corporations, Entrepreneurs and Policy Makers

This is the first in a series of posts by George Carras, R-LABS Founder and CEO, sharing learnings and ideas. The goal is to engage those who know there’s a better way to solve problems in real estate and housing through improved alignment between corporations, entrepreneurs and government.

Every challenge can be an opportunity of equal or greater magnitude if you have an innovation mindset, motivation and the capability to act. Real estate is a problem-rich environment and is currently operating through a business model that hasn’t changed in several generations.

Business models have great power – but also limits. We are at a point in time where both are being discovered. Venture building is a highly effective way to align large corporations (both inside of real estate and outside of real estate with unique capabilities from other industries) with game-changing entrepreneurs alongside policy makers to solve the major problems we are facing.

To truly understand the opportunities for innovation in real estate, we’ll first dive into where real estate fits amidst other industries in the innovation landscape. Then, let’s explore why venture building is a viable path for solving complex problems and impacting greater change in our industry.

THE REAL ESTATE BUSINESS MODEL IN PERSPECTIVE

What’s a Business Model?

A business model is not limited to private businesses, it also applies to government agencies and non-profits. It describes how an organization creates, delivers, and captures value, in economic, social, cultural or other contexts.

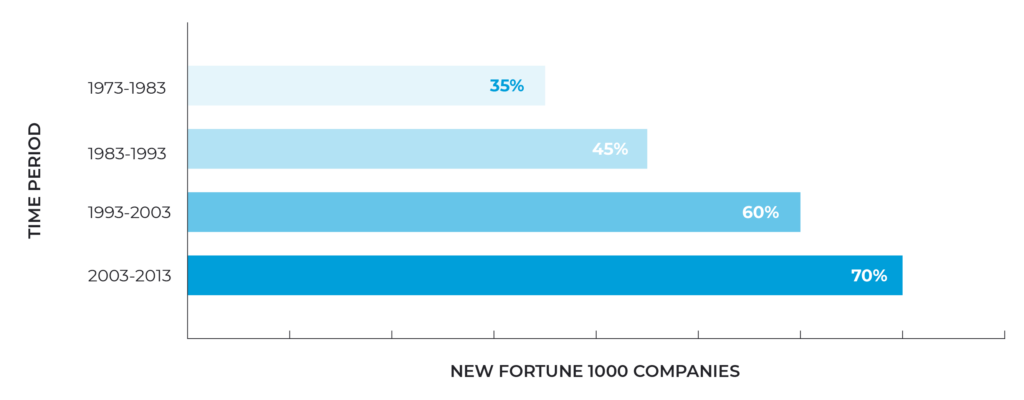

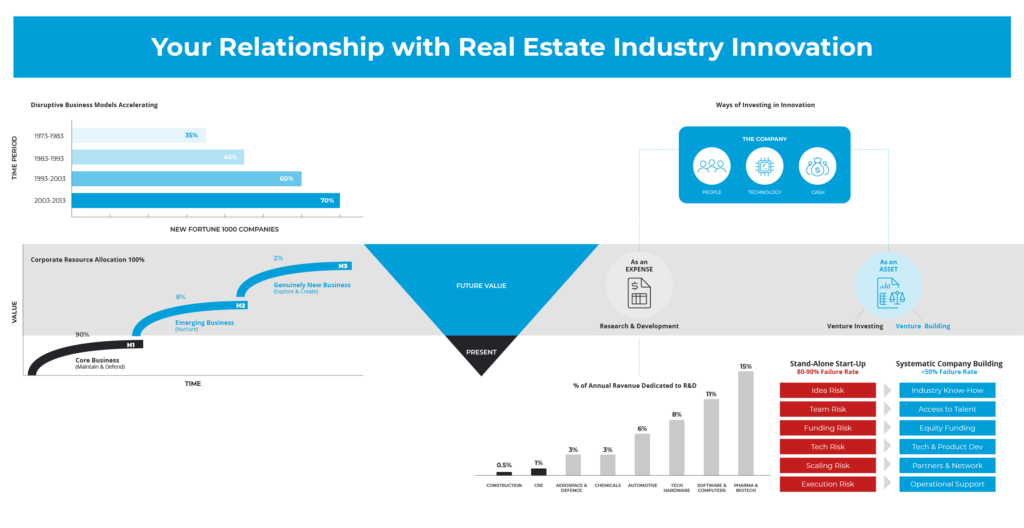

Over the past 50 years, technology-enabled disruption in business models has been accelerating in other industries.

But is Real Estate Different?

While business models in other industries have evolved extensively, those in real estate and housing have remained largely unchanged. In fact, the real estate business model that exists today was the same as the one present when most of us were born. The reason is because it’s been accepted (by most) as a good model and those inside of it are not equipped to make it change (see research on barriers to innovation below), and those outside of it have not found a way to make it change. Yet.

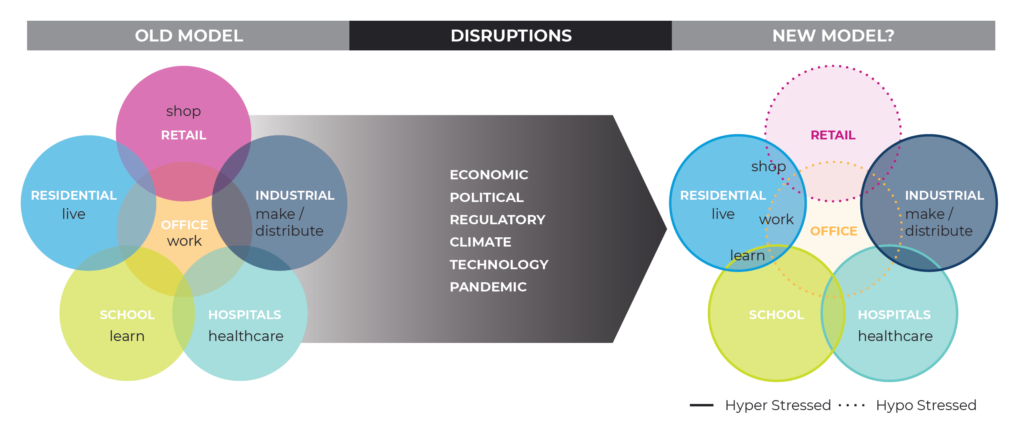

Real estate is in the “where?” business. Where do you work? Where do you shop? Where do you live? Technology, by contrast, is in the “how?” business. How do you work? How do you shop? How do you live?

The definition of a hyper-stressed asset class is when the demands on it exceeds its abilities. Think about hospitals and how their limited capacity has influenced the behaviour in the community and the economy. Think about residential real estate and how much more is being required from that asset class and how much more of it we need. In this post last fall, R-LABS covered the dire need for new housing supply in the Greater Golden Horseshoe and ways to improve the flow in new housing.

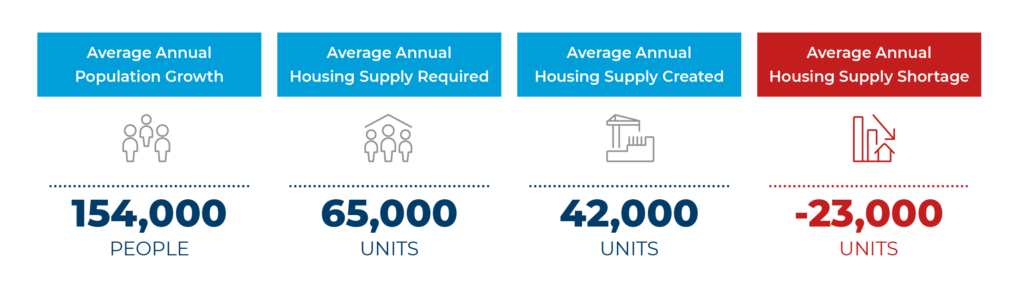

With a population of 8 million people and the real estate industry in the Greater Golden Horseshoe working flat out at full capacity, supply is likely to be short by 23,000 units per year. For context, that’s approximately one Town of Aurora per year.

Housing supply is regarded by many as a big problem. But as Henry Ford said, “There are no big problems, there are just a lot of little problems.” (Question: do you think Henry Ford created a car company or transformed human mobility? And could he have accomplished either if governments hadn’t built new roads for those cars to drive on?)

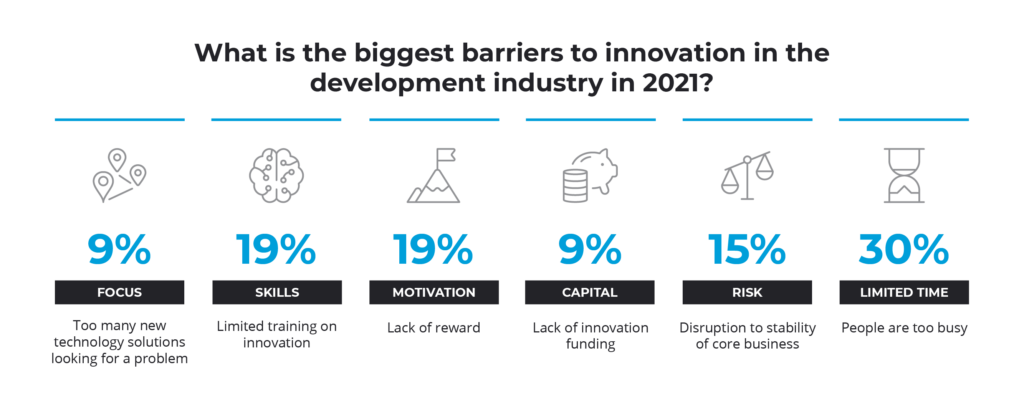

While the need for innovation is great, relying on innovation coming from inside real estate alone is unlikely enough to solve the problems. In a survey conducted by R-LABS last year, we asked what you felt were the barriers to industry innovation (many thanks for your insights!)

Respondents indicated that time was the biggest barrier. Most in the real estate industry are too busy executing on their core business, and have no time to dedicate to innovation followed by no motivation or necessary skills.

Research and Development Across Industries

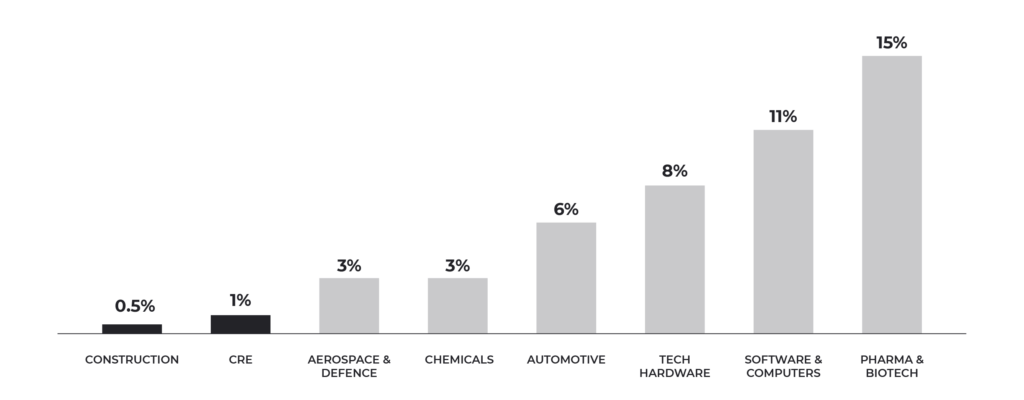

A 2019 whitepaper created by R-LABS, REALPAC and PwC illustrated that R&D, while present in many other industries, has been virtually non-existent in real estate.

But look at the other industries. With an average R&D investment of 15% of revenue being made consistently, year over year, it’s not hard to see how Pharma and Biotech was able to create multiple effective vaccines in record time in response to the COVID-19 virus. Similarly, in industries like software, hardware, automotive, chemicals etc., R&D as a line item in the financials is expected for corporations to succeed, and investors reward it.

While the existing real estate business model will likely continue for decades to come, this doesn’t mean that new models won’t be formed alongside. A business model will work until it doesn’t. We need to appreciate that every business model has a limit and new technology enabled business models are extremely powerful at delivering global change.

THE THREE HORIZONS OF THE BUSINESS MODEL

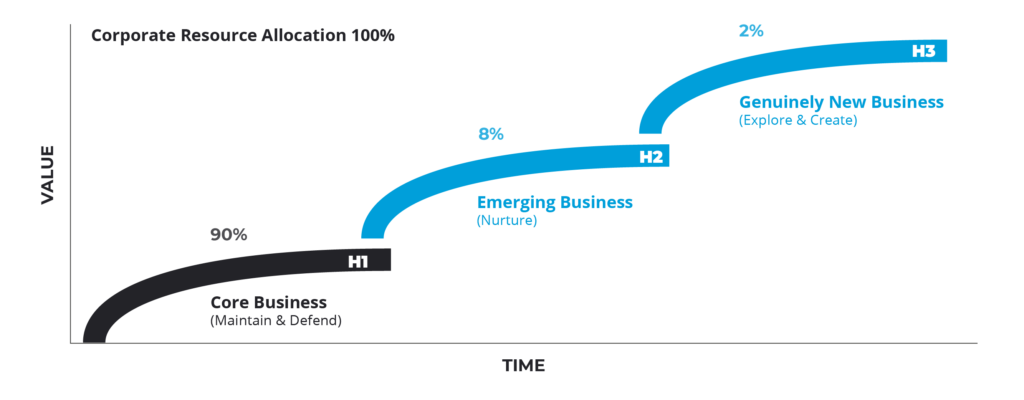

Many corporations (generally outside of real estate) use the three horizons framework to govern their thinking about how to invest in their future:

Horizon 1 – Maintaining and defending the core business through core products.

Horizon 2 – Emerging business models that nurture the core business by making incremental innovations.

Horizon 3 – Investment in breakthrough innovations, seeding genuinely new business models.

Corporate asset allocation (I.e., where companies invest their money) in practice is believed to be 90% of assets invested in Horizon 1, 8% of assets invested in Horizon 2, and 2% of assets invested in Horizon 3.

The time considerations for these three horizons in the early days of this framework thinking were that Horizon 1 investments were made over a 1–2 year period. Horizon 2 investments were made over 3-5 years, and Horizon 3 investments were made for the longer term with a 5+ year time horizon. More recently, Silicon Valley legend Steve Blank has suggested that the speed for Horizon 3 is more in line with Horizon 1 timing of the past, by leveraging existing technologies moving at speed in new business models (ex. Uber, Airbnb, SpaceX, Tesla and others.)

“In the 21st century the attackers have the advantage, as the incumbents are burdened with legacy” – Steve Blank

Remember that a corporation is a permanent organization that is executing on a business model and a startup is a temporary organization that is trying to find a business model. Startups are a key part of the innovation ecosystem, but trying to create startups inside of a corporation is highly problematic as the immune system of the corporation, identifying the disruptive nature of the start-up to its established business model will kill it.

INVESTING IN REAL ESTATE INNOVATION

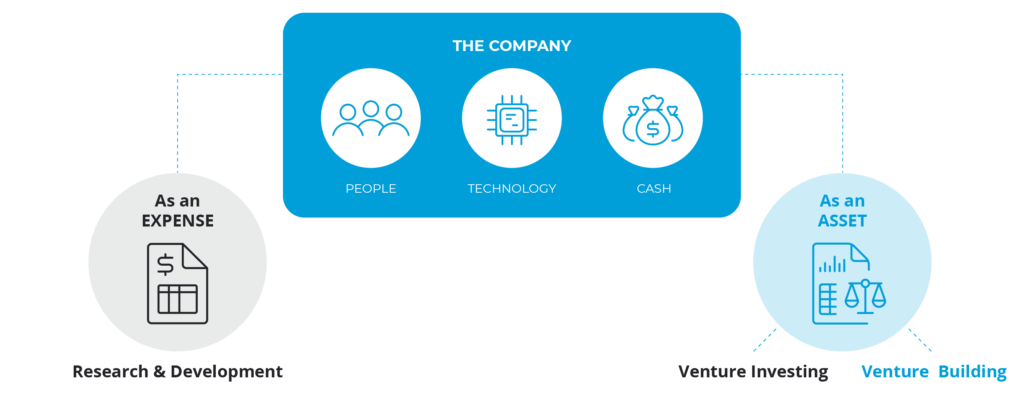

At a high level, corporations have two ways to invest in innovation:

Investing in innovation as an expense from the P&L. This is usually in the form of R&D, which reduces the company’s EBITDA margins. This is extremely rare in real estate and investors in the past have not rewarded this behavior. As noted earlier however, R&D investments in other industries is quite common and this is increasingly strategic for corporations outside of real estate looking at real estate problems as opportunities in their business Horizons 2 & 3.

Investing in innovation as an asset from the balance sheet. There are two ways to invest in innovation from a balance sheet: venture investing and venture building. This is usually where startups play a role in a corporation’s Horizon 2 & 3.

Venture Building vs. Venture Investing

Venture investing is the more common approach in using the corporation’s balance sheet. The corporation can make direct investments into one or more startups, invest into a venture fund (where the fund invests in the startups) or create its own corporate venture capital platform.

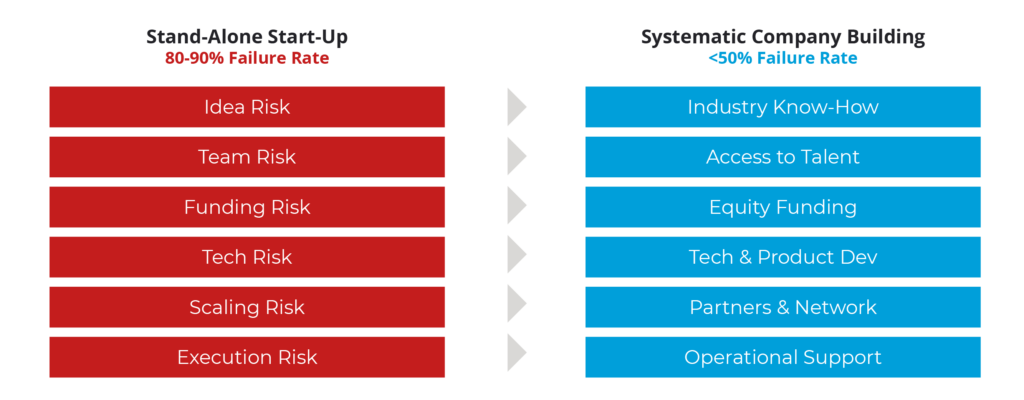

Venture building is a less common approach than venture investing, but offers several key strategic advantages. Standalone venture (i.e., an entrepreneur with a technology meets investors with ideas), is responsible for approximately 95% of all ventures, and 80-90% of them fail, meaning both the founders and investors share that fate. Venture building or structured company building has played a smaller role in the venture ecosystem, explaining only 5% of ventures that exist, but has produced a 50% failure rate. So in comparison, venture building has a 5X greater probability of success over standalone venture investing through better ways in managing risks and improved relationship and alignment with entrepreneurs.

When focused on a specific sector like real estate and housing, venture building is a highly effective way to align corporate innovation with entrepreneurs and policy makers to deliver industry innovation, solve major problems, and create enterprise and community value.

Corporate Innovation in Partnership is Creating Industry Innovation in Real Estate

Innovative Corporations both inside real estate and outside real estate have the ability to grow their long-term enterprise value from their balance sheet through venture building. When venture building is aligned in a partnership with an Industry problem focus, Industry Innovation can be engineered alongside game changing entrepreneurs (more here in a future post) and policy makers.

CALLING ALL REAL INNOVATORS

Who are you? What problem do you love? What role do you want to play?

R-LABS is The Real Estate Industry Venture Builder and builds innovative companies that solve major problems in real estate. Are you a Real Innovator? Do you believe there is a better way to solve the problems of our day and choose to Innovate in Real Estate and Housing? If so, R-LABS is here to partner and help you grow. The best way to predict the future is to help create it and Real Estate and Housing is something we are all in together.

Please connect with us. There is much good work to be done together.

"*" indicates required fields