In the article below, Lovish Gupta, Head of Research at R-LABS, takes a comprehensive look at the assignment sale transaction process and highlights key areas for innovative solutions.

Over the past few years, population growth and housing demand in the Toronto market has led to an increase of pre-construction condo projects, and as a result, assignment sales have become a much more common practice.

While many investors and industry professionals are familiar with assignment sales, the influx of public interest has highlighted a number of pain points in the process. Many people are unaware of the tight timelines, marketing challenges and onus that come with an assignment sale. It’s a problem that we’re trying to solve in the Lab but first, we need to find clarity around the problem.

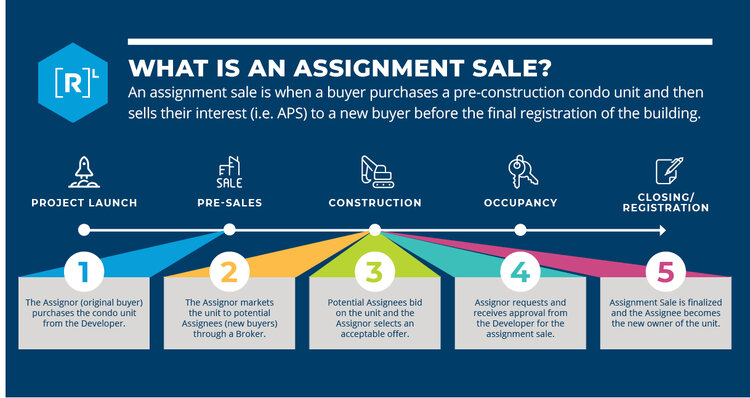

What is an Assignment Sale?

An assignment sale is a type of new condominium sale which occurs between the original buyer, the Assignor, and a new buyer, the Assignee. The Assignor purchases a unit from the condo developer with the intention of selling before the project closes. From there, the Assignor works with a broker to market the unit to potential Assignees.

After reviewing offers from the potential Assignees, the Assignor will select their desired offer and go to the developer for approval. If the developer approves the assignment sale, the Assignor sells their interest, also known as their Agreement of Purchase and Sale (APS), in a preconstruction property and the Assignee becomes the new owner of the unit.

There are many reasons why an Assignor may choose to sell on assignment: perhaps they are an investor looking to profit from price appreciation, they may have experienced a change in lifestyle (e.g. having children, new job, etc.), or they are no longer able to close. On the other side, Assignees may choose to buy on assignment because they don’t have to wait as long for their unit to be built, or they are able to buy the unit at below market value.

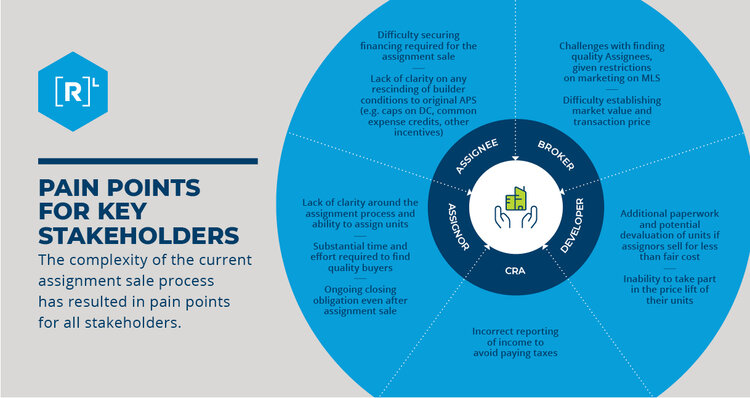

Pain Points for Key Stakeholders

The current assignment sale process is complicated and difficult to navigate. Each assignment sale involves several stakeholders often working in silos. As a result, each stakeholder is faced with their own set of challenges in the assignment sale journey.

Assignor

The biggest challenge for Assignors is the time and effort required to complete an assignment sale. Marketing restrictions and strict financing requirements for the Assignee can make it difficult for the Assignor to attract potential buyers. On top of that, each developer has a unique set of conditions for assignment sales (e.g., caps on development charges, common expense credits, and other incentives) and must approve all assignment sales before they are finalized. Should the sale not be approved, the Assignor not only loses the sale, but they also have an ongoing obligation with the developer to close on the unit.

Assignee

When it comes to Assignees, the most common pain point is financing for the assignment sale. Assignment sales require a large amount of payment to be provided upfront in order to close the deal. This payment includes all deposits already made by the Assignor, plus the premium paid on the unit. In addition, the assignee needs to have clarity on existing builder conditions to original APS and has limited control on the previous decisions made by the Assignor (e.g. décor, upgrades)

Broker

For Brokers, there is usually a knowledge gap with assignment sales when compared to a real property sale – particularly around marketing. MLS restricts brokers from marketing assignment sales through their platform which can make it very difficult to find potential Assignees. While there are brokers who specialize in assignment sales, there is no standardized platform for marketing assignment sales. This makes it harder to convince clients to consider an assignment sale, determine market value, and set a transaction price.

Developer

Not only do assignment sales result in additional paperwork for the developer, but they are also unable to take part in the value increase of the property. Assignment sales may also lead to the devaluation of un-sold units if assignors sell for less than cost. In addition, the developer may deal with inquiries from the CRA due to income-reporting related questions.

Canada Revenue Agency (CRA)

Once the assignment sale is complete, the CRA has to account for incorrect income reporting by the Assignors. Currently, there is no central database to record assignment sale transactions in Ontario – making it difficult to track evaders without manually going through records of individual developers and buyers.

Assignments Around the World

What is see in Ontario’s housing market is echoed in many other parts of the world. From Vancouver to Dubai, here are some ways global cities are addressing the problems in the assignment sale process:

Vancouver, BC

In Vancouver, condo-flipping has led to increased real estate prices and income tax evasion on assignment sale profits. In an effort to regulate assignment sales transactions and cool the market, the BC government launched the Condo and Strata Assignment Register (CSAIR) on November 5 th , 2018.

CSAIR is a database that keeps track of buyers who have sold the units they have purchased, bringing transparency to the market and ensuring accurate income reporting. Since January 1, 2019, developers are responsible for collecting and reporting information on all assignments of purchase agreements. The database ensures that all assignors pay the applicable income tax, capital gains and property transfer tax.

Dubai, UAE

In the early to mid-2000s, the rise in property flipping resulted in the property bubble burst and investors were left with over-priced properties. The Dubai Land Department (DLD) responded by partnering with the Real Estate Regulatory Authority (RERA) on a pre-construction management system called Oqood (meaning “contracts” in Arabic).

The Oqood portal provides a uniformed and centralized method for registering all types of contracts between developers and buyers, including assignment sale contracts. Once the pre-construction project receives a completion certificate, the information is passed through the portal and the property is seamlessly transferred to the Property Register at Dubai Land Department. Oqood is also a government-mandated program so failing to register the sale in the portal will result in a voided contract.

Improving the Assignment Sales Process in Ontario

The number of assignment sales continues to increase with the growth of the pre-construction condo market. Because of this, there is an urgent need to standardize the inefficient assignment sale process in the Ontario and beyond.

In the Lab, we’re exploring purpose-driven solutions that tackle multiple pain points in preconstruction sales. This may involve the creation of a centralized registry that brings transparency through tracking all assignment sales, or a transaction portal that ensures all stakeholders are communicating with each other rather than working in silos. Another possible solution may be introducing assignment financing options to help assignees close the deals. Ultimately, we see an opportunity to streamline the assignment sale process and bring transparency to the pre-construction condo market, bringing value to all stakeholders.

If you’re interested in improving the assignment sales process, reach out to [email protected] and learn how you get involved in our upcoming solution.