In the evolving landscape of entrepreneurship, a unique model has emerged that blends the creativity of startups with the structure of established organizations. Known as venture builders or venture studios, these entities are reshaping how startups are conceived, developed, and launched.

Rather than acting as passive investors or accelerators, venture builders take a hands-on, long-term approach to building startups from the ground up. They don’t churn out dozens of companies a year; instead, they focus on a few high-potential ventures, nurturing them with deep operational support and strategic guidance.

What Is a Venture Builder?

A venture builder is an organization that creates startups internally, using its own ideas, resources, and teams. Unlike venture capital firms that fund external founders, venture builders initiate the startup process themselves. They identify promising opportunities, validate them, and then assemble teams to bring those ideas to life.

This model is particularly appealing to entrepreneurs who want to focus on building a product without the burden of starting from scratch—handling legal, HR, fundraising, and other operational complexities.

How Venture Builders Operate

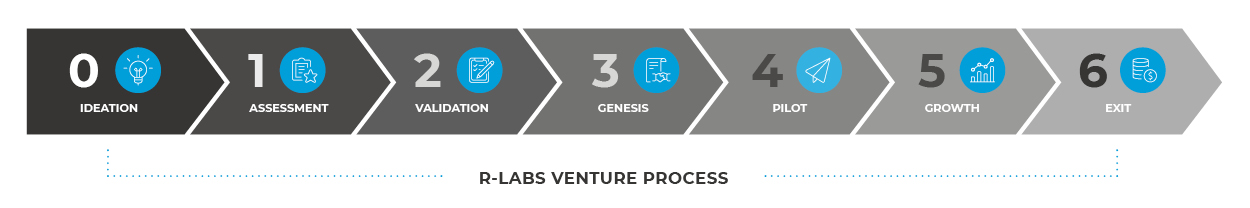

The venture builder process is methodical and iterative, typically involving the following stages:

- Ideation: Builders research market trends, customer pain points, and emerging technologies to uncover viable startup ideas.

- Assessment: Ideas are scored against the venture builder criteria.

- Validation: Ideas are tested through market research, prototypes, and early user feedback to assess feasibility and demand.

- Genesis: Once validated, a founding team is assembled, funding is arranged, and pilot customers are confirmed.

- Pilot: The startup is launched with support from the builder’s shared services, including legal, finance, design, and marketing. Pilots are executed.

- Growth: As the startup gains traction, and continues scaling within the builder’s ecosystem.

- Exit: Eventually the venture builder may exit the startup via acquisition by a strategic investor, IPO, asset sale or by ither means.

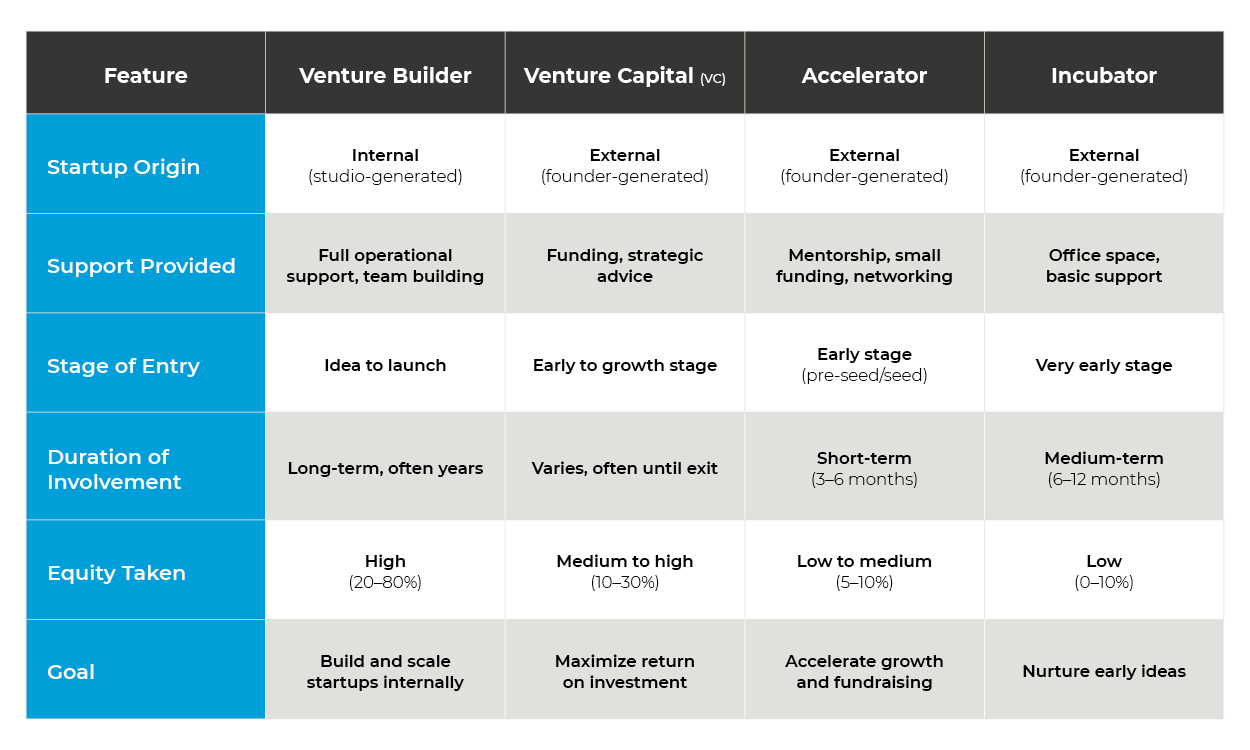

Venture Builder vs. VC vs. Accelerator vs. Incubator

Understanding how venture builders differ from other startup support models is key:

In essence, venture builders are co-founders, not just supporters. They are deeply embedded in the startup’s DNA from day one, unlike VCs who invest in existing teams, or accelerators/incubators that provide short-term guidance.

Venture Builders Advantages

The venture builder model is gaining popularity for several reasons:

- Higher Success Rates: Startups launched through venture builders often have higher survival rates due to rigorous validation and experienced support. 60% of start-ups coming out of a venture builder make it to a Series A Round.1

- Efficient Use of Capital: Shared services and infrastructure reduce duplication and overhead.

- Higher ROI: The average IRR for a start-up is 21.3% vs 53.0% IRR for start-ups created by a venture builder. 1

- Strategic Focus: Builders can align ventures with long-term themes or industry verticals, creating synergies across their portfolio.

- Appealing to Entrepreneurs: Founders can focus on product and growth, while the builder handles the operational heavy lifting.

Real-World Examples

Some of the most respected venture builders include:

- eFounders (France): Specializes in SaaS startups and has launched companies like Front and Aircall.

- Flagship Pioneering (USA): Known for launching Moderna with a focus on Life Sciences.

- Rocket Internet (Germany): Focuses on replicating proven business models in emerging markets.

- R-LABS (Canada): Focuses on building companies that solve important problems in real estate and housing.

Is a Venture Builder Right for You?

If you’re an entrepreneur who values collaboration, structure, and access to resources, joining a venture builder could be a great fit. You’ll benefit from a support system that increases your odds of success while allowing you to focus on what you do best.

For investors and corporations, venture builders offer a compelling model for de-risked innovation and strategic portfolio building.

Conclusion

Venture builders are strategic incubators of innovation, carefully crafting each venture with intention and expertise. As the startup ecosystem matures, this model offers a promising path for building resilient, scalable companies more thoughtfully and sustainably.

Sources: 1. Morrow’s Global Startup Studio Network (GSSN) Disrupting the Venture Landscape whitepaper published on October 28, 2022.